This is the true value adding services to our clients. You never need to worry about missing any tax deadlines or get stressed at year end to pay your taxes. With our monthly plan, you will know your revenue, net profit, GST and taxes all on a monthly basis. You will find this kind of information are very valuable to run your businesses.

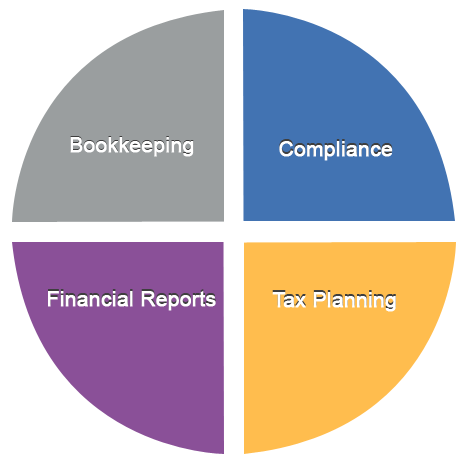

ALL-INCLUSIVE SERVICES

Bookkeeping:

Bookkeeping:

- Monthly bookkeeping preparation and receipts organization

- Organize Receipts to our Easy-to-find Systems

- Enter Data into Meaningful AccountsUse Professional Bookkeeping Software: Quickbooks, Quickbooks Online or Simply Accounting

Financial Reports:

Financial Reports:

- Prepare monthly financial snapshot with visual graphics to help you understand your financial performance

- Calculate taxes on a monthly basis to smooth out year end cash flow

- Prepare Yearly Notice To Reader Financial Statements

Compliance:

Compliance:

- GST Preparation and filing according to your filing period

- Payroll Preparation and Filing according to your filing period

- Year End Tax Preparation and Filing

Tax Planning and Consulting:

Tax Planning and Consulting:

- Create a customized tax saving plan that fits your personal and company financial needs

- Plan ahead with experienced certified public accountant to ensure best tax strategy is achieved.

- Monthly bookkeeping preparation and receipts organization

- Monthly financial reports with visual aids and key financial figures to help you understand your financial performance

- GST preparation and filling according to your filling frequency

- Payroll preparation

- Year-end preparation with Notice To Reader report issued by Certified Public Accountant

- Year-end corporate tax preparation and filing

- Year-end tax planning to make sure you are paying the least amount of taxes for your company and family altogether

- T4/T5/T5018 preparation and filling if applicable

- 1 hour free support from our experienced accountants every month

- Personal Taxes

- Correspondence with Canada Revenue Agency due to an audit or review

- Tax consulting on complicated tax matters includes but not limited to amalgamation, preparation for capital gain deduction, GST rebate application on new building, trust, etc.

- Review and audit engagements

- Any previous bookkeeping, tax and year-end catch up work*.

The above services are not included in the monthly plan; we charge additional but reasonable fee if requested by our clients.

*If clients are involved in the monthly plan, we will help our clients catch up previous bookkeeping and tax filings at a discounted rate.